Book a safe journey to Spain and explore the country worry-free, while following the laws and discovering the beautiful cities of Spain!

An entire country with beaches, history, landscapes, culture, and art is ready to be discovered from top to bottom. By using secure travel measures in Spain, you can explore the various attractions with peace of mind and safety. Whether you’re visiting Madrid or hiking the trails of Santiago de Compostela, having insurance is necessary due to local laws.

In this article, we will discuss the Schengen Treaty, an agreement that the country is a member of, and that mandates secure European travel for visitors to any of the countries that have signed it. Additionally, we will provide guidance on utilizing an online insurance comparison tool to find the most competitive prices. This tool offers a variety of options tailored for different types of trips, including short and long durations, as well as specific demographics such as seniors, expectant mothers, and adventure enthusiasts.

Text: Keep reading to receive a special discount for booking the top safe travel services in Spain, ensuring a peaceful trip with any unexpected issues easily resolved! Ready to pack for Spain?

In this article, you will find:

- What is the safest and most enjoyable way to travel to Spain?

- How expensive is a secure journey to Spain?

- Coupon offering a discount for secure travel

- Is it obligatory to travel to Spain safely?

- Paraphrase: The Schengen Treaty is a document that established an agreement among European countries regarding border control and free movement of people within the region.

- Can you explain how the healthcare system operates in Spain?

- Is there a secure and complimentary journey to Spain available?

- Why invest in a safe journey to Spain?

- Text: What types of insurance coverage are available for traveling to Spain?

- Explanation of the process of safe travel

- How to ensure safe travels

- What kinds of travel insurance are available?

- Which secure travel option to select for Spain?

- How to arrange a secure trip to Spain.

- Is it safe to travel to Spain? Does Spain offer insurance coverage for coronavirus?

- Top Insurance Companies in Spain

- I’m sorry, but you didn’t provide any text for me to paraphrase. Please provide the text you’d like me to work on.

- “Chip for mobile use in Spain”

- Sightseeing excursions and admission passes in Spain

- Commonly Asked Questions

What is the safest and most recommended way to travel to Spain?

The top recommended travel insurance option for a trip to Spain is the Affinity 60 Europe Promotional +COVID-19 plan. This plan offers excellent value for money and provides more extensive coverage compared to the standard insurance required for entry into Schengen Treaty countries. While the mandatory coverage is €30,000, this insurance plan covers up to $60,000. Additionally, it includes physiotherapy services and covers pregnant women up to 32 weeks.

We have also divided the MTA 40 Europe + Telemedicine Albert Einstein plan, which includes coverage for expectant mothers and telemedicine services, and the AC 150 EUROPE (excluding USA) COVID-19 plan, which also covers expenses related to Covid-19. These plans offer significant coverage for medical expenses, with limits of $40,000 and €150,000, respectively.

Next, we will provide more information about each option and create a table to assist you in selecting the perfect insurance for your trip.

Europe Promotion Affinity 60 and COVID-19

Text: Includes $60,000 medical-hospital coverage and $800 baggage insurance, as well as protection for sports, dental emergencies, physiotherapy, and pharmaceutical refunds. Check prices for more details.

European MTA 40 with Telemedicine from Albert Einstein

Text: Includes $40,000 in medical-hospital coverage, $1,200 in baggage insurance, as well as coverage for sports, dental emergencies, telemedicine, and pharmaceutical refunds. Check out pricing details.

Europe (excluding the USA) COVID-19 costs 150 euros.

Text: Protection of up to €150,000 for medical and hospital costs, along with €1,200 in baggage insurance. Additionally, the coverage includes sports-related incidents, dental emergencies, support for expectant mothers, and protection against Covid-19. Check out the prices for more details.

Please refer to the information provided below for further details on top insurance companies, or explore alternative choices using the online comparison tool.

| Insurance | Affinity | My Travel Assist | Watch Card |

| Plan | Affinity 60 Promotional Europe +COVID-19 | MTA 40 Europe +Telemedicina Albert Einstein | AC 150 EUROPE (except USA) COVID-19 |

| Medical and hospital expenses | $60,000 | $40,000 | € 150 thousand |

| Medical cover for sports | Inside the DMH | Inside the DMH | Inside the DMH (per event) |

| Coverage for pregnant women | Inside the DMH – Up to 32 weeks | Inside the DMH – Until 28 weeks | Within the DMH (per event) – Until 28 weeks |

| Dental cover | $400 | $250 | €700 |

| Pharmaceutical cover (refund) | $400 | $250 | € 1 000 |

| Medical expenditure by covid-19 | $30,000 | $10,000 | € 30 thousand |

| Regression | $30,000 | $20,000 | €60,000 |

| Flight delay costs | $300 (6 hours) | $200 (8 hours) | € 100 (6 hours) |

| Assistance in the location of extraviated suitcase | No | Yeah. | Yeah. |

| Damage to the bag | No | No | No |

| Extraviated baggage insurance | $800 (complete) | $1,200 (supply) | € 1,200 thousand |

| Legal assistance by traffic accident | No | $1,000 | € 4 000 |

| Insurance value | $ 10,42 (per day) | $1,23 (per day) | $ 30,64 (per day) |

What is the price of a secure journey to Spain?

It is possible to rent a secure travel package in Spain starting at prices as low as R $ 10 per day. You can also utilize the online insurance comparison tool to view the various plans on offer.

The insurance coverage amount can differ based on the individual purchasing the service or the activities they plan to engage in at the destination. For instance, an older individual may have a slightly more costly travel insurance plan compared to a 20-year-old, and an athlete planning to participate in extreme sports during the trip may also require a plan with a slightly higher cost.

The insurance is usually affordable and provides great value by offering peace of mind for a stress-free trip. In case of an emergency, you can simply activate the insurance and it will handle everything for you.

The reality is that people buy insurance for peace of mind and hope they never have to use it. But if the need arises, having this backup can be beneficial during a crisis.

Explore all the available travel insurance choices in Spain.

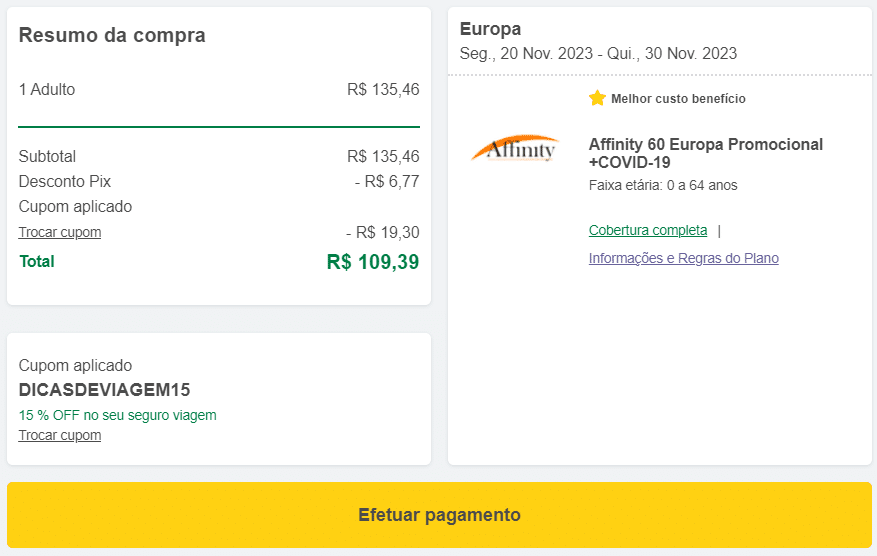

Coupon offering a discount for secure travel

It’s more beneficial to purchase insurance for your trip at the most competitive price rather than having coverage for emergencies. Readers of Travel Tips can take advantage of a 15% discount on the final price by using the coupon code DICASDEVIAGE15. Sounds like a great deal, doesn’t it?

Oh, and there is an additional 5% discount for those who pay with boleto, pix, or bank transfer, with these discounts being able to be combined. This means you can save up to 20% on booking your secure travel to Europe. Also, keep in mind that you can pay for the insurance in installments of up to 12 times, making it easier to manage payments.

- Click to use the coupon code DICASDEVIAGE15 and receive a 15% discount.

- Make a payment via billet, Pix, or transfer to receive an additional 5% discount and reach a total savings of 20%!

Is it required to travel to Spain safely?

Text: Ensuring a safe journey to Spain is essential. Spain is a member of the Schengen Treaty along with other European countries. Failure to have a proper travel plan in place may result in deportation. It is important to have proof of safe travel available upon immigration request to avoid any disruptions to your trip. Being prepared for this situation is crucial for a smooth travel experience.

Text: Insurance is not only necessary but also highly advised, with comprehensive coverage to safeguard you both physically and financially. This way, you can fully enjoy the various attractions and tours in incredible cities with peace of mind and security.

The acquisition of travel insurance for a trip to Spain is highly significant, to the extent that the Brazilian government offers a detailed article emphasizing the necessity of travel insurance for Brazilian travelers venturing overseas.

Explore all the different travel insurance choices available for Spain.

The Schengen Treaty refers to the agreement known as the Schengen Agreement.

The Schengen Treaty is a pact among 27 countries that allows for unrestricted travel between the involved nations. This means that individuals can move across borders without facing excessive red tape. Travelers must ensure they have purchased a travel insurance plan that includes medical coverage of at least 30,000 euros. Therefore, it is important to carefully select a plan that meets this requirement when making a reservation.

The Schengen Treaty includes the following countries: Germany, Austria, Belgium, Croatia, Denmark, Slovakia, Slovenia, Spain, Estonia, Finland, France, Greece, Netherlands, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Poland, Portugal, Czech Republic, Sweden, and Switzerland.

Romania, Bulgaria, and Cyprus are currently in the process of implementing the Schengen Treaty. The United Kingdom and Ireland are not included in the Schengen Treaty.

How does the healthcare system operate in Spain?

In Spain, the healthcare system is both free and available to all, with the possibility of using a private network. Individuals living in Spain are required to make regular contributions to the tax system, which includes income tax. This allows them to obtain a health card and enroll in the Social Security system, granting them access to primary and specialized healthcare services.

Therefore, individuals who hold Spanish citizenship, have legal residency in Spain or in countries with bilateral agreements with Spain to provide assistance to their citizens – such as European citizens and visitors from Andorra, Chile, Morocco, Peru, Tunisia, Switzerland, Norway, Iceland, and Liechtenstein – are eligible to receive complimentary healthcare services.

The Royal Decree-Law of Universal Access to the National Health System requires hospitals to provide care for all emergency cases, including those involving illegal visitors or residents, such as pregnant women in labor. Despite this requirement, it is not advisable to solely rely on it to reach a hospital in case of emergency.

In Spain, tourists can only receive non-emergency medical consultations through private healthcare services. This means that if a situation is not deemed urgent by doctors, the visitor will need to pay for the treatment. Therefore, it is crucial for Brazilian travelers to have comprehensive travel insurance when visiting Spain to ensure they receive the necessary care in case of a health issue.

Explore all available travel insurance choices for Spain.

Is there a secure and complimentary journey to Spain available?

Yes, it is possible to utilize complimentary travel insurance in Spain. One method to access this benefit is by using a secure credit card for travel, as long as you have purchased your tickets with a card that includes this feature. In such instances, there is no additional cost to activate the travel insurance.

Another option is to utilize the global coverage provided by the Brazilian health plan, if this feature is included in the chosen plan. While not a traditional travel insurance, this is a convenient alternative that is already covered by your monthly payments, eliminating the need to purchase a separate travel insurance policy and incur additional expenses.

In any case, if none of these options suit you without any additional charges, it is advisable to review the plans available on the online insurance comparison tool. These options are carefully considered and provide extensive coverage to give you peace of mind during your trip.

Explore all available travel insurance choices in Spain.

What are the benefits of purchasing a safe journey to Spain?

It is crucial to ensure a smooth journey to Spain to avoid being sent back as soon as you arrive in the country. Having a plan in place is important not only to meet requirements but also to safeguard your financial investment. Unexpected expenses can disrupt your travel plans, while issues with paperwork can lead to unnecessary stress and disrupt your enjoyment of the trip.

By having insurance, you can have peace of mind knowing that if something goes awry, you will receive the necessary assistance from knowledgeable and equipped professionals. For instance, a minor issue like a toothache can disrupt your trip, but insurance plans typically include coverage for dental emergencies, allowing you to quickly resume your travel plans.

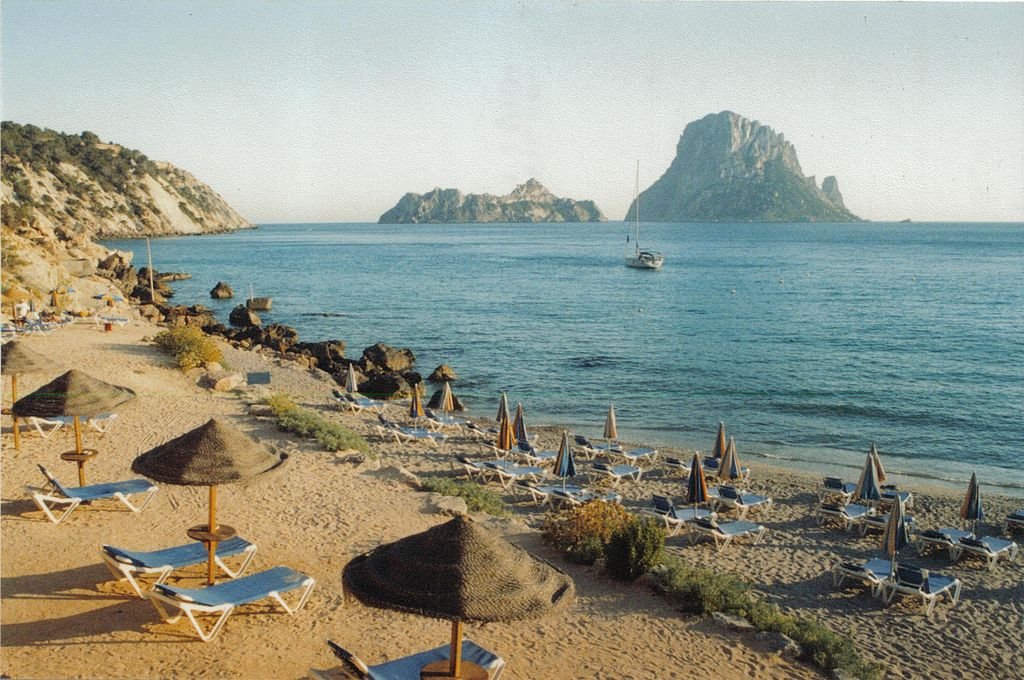

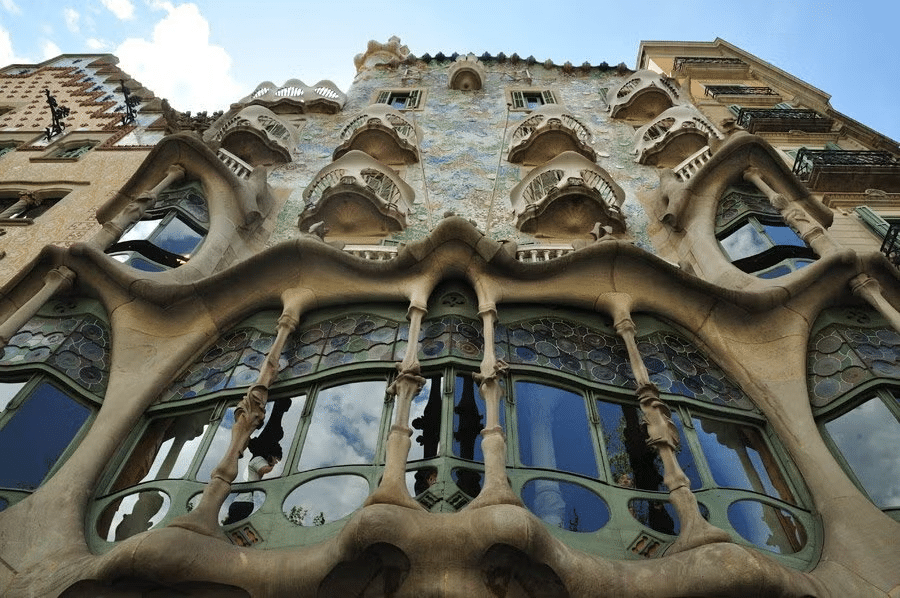

Explore the beaches of Ibiza, the hotels of Seville, the scenery of Barcelona, and the architecture of Madrid confidently, thanks to the peace of mind that comes with having insurance to cover any unexpected situations. 😉

Explore all available travel insurance choices in Spain.

What types of insurance policies are available for traveling to Spain?

Travel insurance typically includes coverage for certain things as a standard, like medical emergencies, hospital stays, and compensation for lost luggage. However, there are more extensive plans available that differ based on the insurance company, the specific type of coverage selected, and other factors.

If you encounter any issues with traffic, such as delays, you can have peace of mind during your journey by utilizing a travel assistance service that also offers legal support. The extent of coverage provided will vary based on the insurance plan you select, which can range from basic to comprehensive.

The most frequent situations that safe travel protection includes are:

- Medical, hospital, or dental services available 24/7 during international trips.

- Paraphrase: The act of returning someone to their home country is known as repatriation.

- Transportation for medical purposes

- Transfer of the body and provision of death insurance during travel

- Complete disability resulting from an accident while traveling

- Legal and financial support

- Passing away or severe illness of a loved one

There are additional protective covers available for rental to ensure a safe journey.

- Assistance for Covid-19 and global health crises.

- Text: Cancelling a trip

- Unintentional early arrival

- Baggage fees for lost or damaged items

- Text: Injuries in extreme sports

- Delayed flight

- The text is about being pregnant.

Explore all available travel insurance choices for Spain.

How the safety of travel is ensured

Travel insurance is a service that ensures travelers receive medical treatment while abroad. It also offers support in various situations, such as legal issues, and can operate through assistance or reimbursement.

The support options provided by the online comparison tool offer immediate assistance during emergencies. In other words, you can reach out to the insurance company for guidance on actions to take, such as directions to a hospital. This service is fully covered by the insurance, so you won’t have to pay any additional costs.

Insurance by reimbursement involves paying for your medical or dental expenses upfront and then submitting the receipts and invoices to be reimbursed by the insurance company. This method is commonly used with secure credit card travel insurance.

Explore all the travel insurance choices available in Spain.

How to promote secure travel

To ensure a safe journey, you can contact your insurance company’s phone number at no cost from anywhere worldwide. The service is always available in Portuguese. Additionally, some insurers offer mobile applications, making communication even more convenient.

Make sure to have your policy number and personal information ready. Inform the attendant of your issue, and they will provide you with the assistance needed to address the situation. Stay calm to comprehend the instructions and resolve the situation effectively.

The key is to thoroughly review the travel insurance policy and comprehend the details of the plan you selected. If you encounter any challenges communicating with the insurance company, don’t hesitate to ask for assistance, as receiving the necessary support is crucial. Next, reach out to the company to address the financial matter.

Explore all the travel insurance choices available for Spain.

What kinds of travel insurance are available?

There are insurance options available for a wide range of travel preferences. Here we outline the most popular types, with more detailed information provided in our comprehensive guides that delve into the specific features of each one.

- Insurance coverage for traveling abroad.

- National travel insurance

- Travel safely while pregnant.

- Secure voyage on a sea cruise

- Secure multiple journeys

- Text: Secure travel to multiple destinations

- Annual travel insurance

- Long-term insurance coverage

- Secure exchange of travel.

- Travel insurance for students

Explore all available travel insurance choices in Spain.

Which secure travel option should I select for Spain?

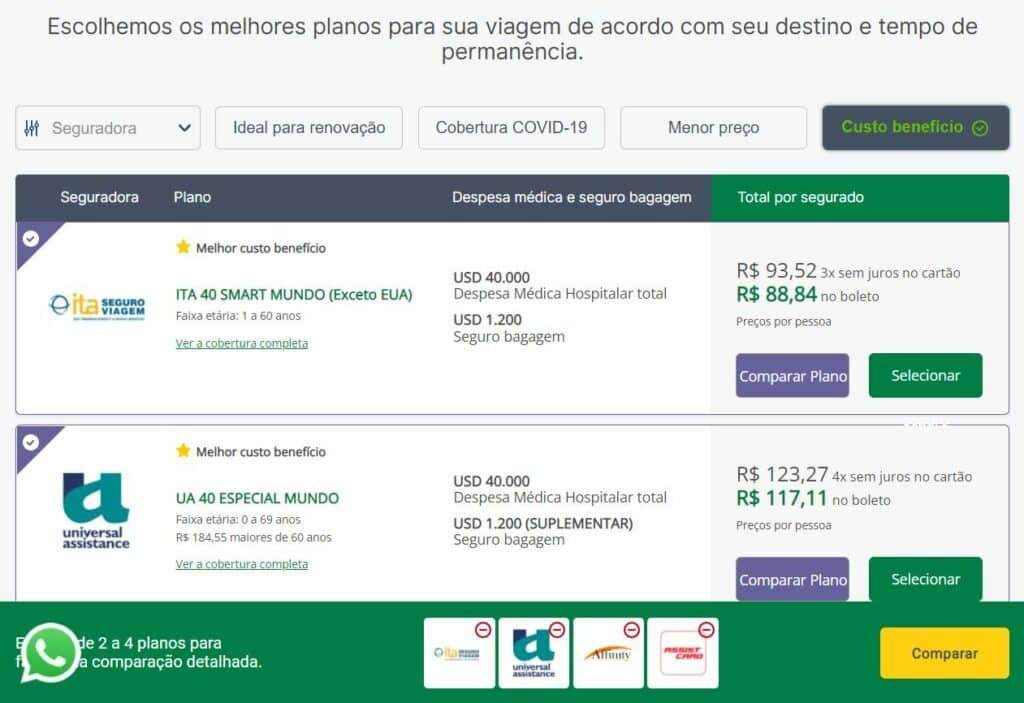

To find the best travel insurance for a safe trip to Spain, it is recommended to utilize an online comparison tool. There are numerous options to choose from on the website, and we will provide some guidance to assist you in selecting the most suitable plan.

Initially, write down the cities you plan to visit at the end of the pencil. Then, shift your focus to planning and consider all the potential details for your trip.

- What activities do you plan to engage in?

- Are extreme sports such as surfing, skydiving, and diving included in the plan?

- Are you currently pregnant or possibly expecting a baby?

- Is there a possibility that the trip may be canceled for any reason?

- Would you like coverage in case your luggage gets lost?

- What is your age? Certain plans provide coverage for individuals who are only up to 70 years old.

- Is your trip going to be extended in duration?

- Are you planning to make an exchange?

After conducting this analysis, you can compare the plans offered by each insurance company and assess the coverage provided for each item. The online comparison tool allows you to compare up to four plans simultaneously and also identifies the most cost-effective options.

Explore all the travel insurance choices available in Spain.

Guide on ensuring safe travel to Spain

Booking a secure trip to Spain is a straightforward process that can be done online. A highly recommended insurance comparison platform is Promo Insurance, a trusted website that provides detailed information on top insurance plans to assist you in decision-making.

On the main page, choose the continent you are traveling to, enter your departure and return dates, provide your name, email, and phone number, and then click on “search safe travel.”

You will be guided to a list displaying the insurance options for your destination. To compare different travel insurance plans, select two to four plans and click on the “compare plan” option. Afterward, click the “compare” button located at the bottom right of the screen. Great! You can now view the benefits of each insurance plan next to each other to help you make a decision and complete your purchase.

After being hired, you will receive your travel insurance policy by email. It is important to keep this document safe as it contains the terms and conditions of the selected plan as well as instructions on how to contact the insurance provider in case of an emergency.

If there is a chance during the trip, you can reach out to the insurance company through phone, WhatsApp, online chat, or email. All contact information is provided in the policy document for your convenience, so make sure to keep it easily accessible.

It’s important to note that all insurance companies featured on Promo Insurance provide round-the-clock customer service in Portuguese, even if you are overseas in a country like France. This ensures that assistance is always easily accessible.

Explore all available travel insurance choices in Spain.

Is it safe to travel to Spain? Does Spain provide coverage for coronavirus?

There are travel insurance plans that provide coverage for medical expenses related to Covid-19, but not all plans offer this benefit.

To make sure your travel insurance includes coverage for Covid diagnosis while abroad, search for plans that explicitly mention this feature. This detail is often highlighted in the title of the insurance policy, as shown in the examples provided. However, it is important to thoroughly review the policy and clarify any uncertainties before making a purchase.

One effective method to find a secure travel insurance plan that includes coverage for Covid-19 is to utilize an online platform that compares different insurance options. This allows you to easily compare the deductibles offered by each insurance provider and select the one that best suits your needs.

Top Insurance Companies in Spain

A frequent question for people planning a safe trip to Spain is deciding on the best insurance company to choose. With many companies available, we offer a guide to help you find the most suitable plan.

Read our articles to discover more about the background of each insurance provider, the available plans, and even their reputation on Reclame Here.

- Can you please provide the text that you would like me to paraphrase?

- Card to be observed

- “Coris Safe Travel” can be rephrased as “Coris Travel Safety.”

- Trip Watching

- Ensure a secure journey.

- Paráfrase: Grand Theft Auto

- Text: Intermac Aid

- Essential Card

- Travel services provided by ITA

- Text: Care for Travel

- Assistance for everyone

- Text: The assistance I receive for my travels.

I’m sorry, but it seems like you forgot to provide the text that you would like me to paraphrase. Could you please provide the text you would like me to work on?

ETIAS (European Travel Information and Authorization System) is a new travel requirement for individuals visiting European countries. Starting in 2025, travelers from visa-exempt countries will be required to obtain authorization from the system in order to enter Europe, including Brazilian citizens.

This rule applies to all Schengen countries, as well as Romania, Bulgaria, and Cyprus, which are still in the process of joining the agreement, along with the microstates of Monaco, San Marino, and the Vatican.

Furthermore, aside from ensuring safe travel to Spain, it will also be essential to acquire authorization for travel to Europe. Failure to request this authorization in advance will result in being unable to travel to the Old Continent.

Mobile chip designed for use in Spain.

How about enjoying uninterrupted internet access throughout your entire stay in Spain? Thanks to international travel chips, this is now achievable at affordable prices that won’t break the bank. Explore the deals from America Chip today and secure internet access for your trip to Spain. Take advantage of our special discount coupon. – VIEW PRICES

Sightseeing excursions and admission passes in Spain.

Have you made arrangements for your trips in Spain? Leave home prepared to avoid waiting in ticket lines and pay in installments without extra fees. Explore tour prices or browse through our top recommendations for a hassle-free experience.

- Exhibition of Flemish art at the Bermejas Towers – Admission fee is €25.

- Guided visit to the Royal Palace costs €29.50.

- Tour of Toledo and Segovia priced at €59.

- Experience the Holy Family visit without waiting in line for €50.

- Ticket for Casa Batlló costs 35 euros.

- Guided visit to Park Güell costs €26.

Explore additional fantastic tours to enhance your travel experience in Spain.

Commonly Asked Questions

Definition of a safe journey: International travel insurance provides medical and hospital assistance while traveling abroad in the event of an accident or emergency. It also includes legal assistance and coverage for lost luggage. Learn more about ensuring a secure trip.

What is the most affordable travel insurance for trips to Spain? The most cost-effective travel insurance option for Spain is the Affinity 60 Europe Promotional +COVID-19, starting at just R$ 10 per day.

What is the top recommended travel insurance plan in Spain for sports enthusiasts? The Affinity 60 Europe Promotional +COVID-19 is a great choice for individuals looking to engage in sports activities in the country, with prices starting from R $ 10.

What is the most recommended travel insurance for pregnant women traveling to Spain? For pregnant women up to 32 weeks, the Affinity 60 Europe Promotional +COVID-19 is the top pick for travel insurance in Spain, with prices starting from R$ 10.

What is the top travel insurance choice for older adults in Spain? The ITA 50 SMART EUROPE +65 is an excellent option for travelers aged 65 to 75, with prices starting at R $18.

Can I go to Spain without travel insurance? It is not advised to skip having travel insurance when visiting Spain, as the country is part of the Schengen Treaty, which mandates travelers to have the document to enter the border. Failing to comply with this requirement can result in deportation.

Can I have a layover in Spain without travel insurance? No, even a brief stopover in Spain necessitates having travel insurance, as immigration authorities require the document regardless of the duration of your stay in the country.

If you travel to Spain without proper documentation, you risk being deported and banned from entering the country, resulting in the loss of your travel expenses. These regulations are outlined in the Schengen Treaty and should be followed by all travelers.

What does the travel insurance for Spain include? The insurance for a safe trip to Spain provides coverage for medical and hospital costs, dental expenses, repatriation of remains, medical repatriation, as well as additional benefits and optional extras that can be added.

What is not included in the travel insurance for Spain? The insurance does not cover accidents caused by travelers who are under the influence of alcohol or illegal drugs, carrying weapons, or engaging in reckless behavior. It is important to be aware of the policy guidelines to ensure you are covered by the insurance.

I am no longer going on the trip. Can I cancel the travel insurance? You can cancel your insurance for a safe trip by contacting the insurance company and making the request at least two days before the trip. Once this time has passed, it is no longer possible to cancel the plan.

How to cancel a safe travel policy? To cancel your travel insurance, get in touch with the insurance provider and ask for cancellation. It’s important to note that this request must be submitted at least two days before the plan expires (departure date). Once this deadline passes, it is no longer possible to cancel the travel insurance.

Can the coverage for safe travels be extended while on the trip? This will vary depending on the insurance provider. Some travel insurance policies allow for extensions during the trip, meaning if you need to prolong your stay at the destination, you can request a new policy extension. Look into travel insurance options that provide this feature.

To prolong your journey safely, you should reach out to your insurance provider and inquire about extending your coverage. This must be done at least two days before your policy expires and is dependent on the insurer’s approval. Check which plans provide continuous coverage.

How does insurance function for individuals traveling to multiple countries in Europe? The insurance coverage purchased from Safe Trip Spain is valid for the entire Schengen area, so it applies to travel throughout Europe. If you are starting your trip in Spain but will be traveling to another country, you should indicate the total duration of your trip when purchasing the insurance plan.

Is traveling to Spain safely expensive? Traveling safely to Spain is affordable, with rates starting from R$ 10 per day offering great value for money.

Individuals with dual citizenship do not require secure travel arrangements when traveling to Spain. They are exempt from needing visas or travel insurance to visit European countries, including those that are part of the Schengen Treaty like Spain.

Only individuals with dual citizenship in European Union countries are exempt from needing to purchase travel insurance for Spain. Nonetheless, it is advisable for all travelers to consider obtaining insurance in order to be prepared for unexpected situations.

Is there complimentary travel insurance available for Spain? No, but it is feasible to discover affordable alternatives that provide excellent coverage starting at R$10 per day.

What additional benefits can you receive by purchasing travel insurance beyond the standard coverage? You have the option to pay for added features such as coverage for canceled trips, early returns, flight delays, protection for extreme sports, and baggage loss or damage. Check out the specifics of the travel insurance plans available in Europe.

Paraphrased: Brazilians planning to visit Spain must have a valid passport and secure European travel insurance. For the most recent entry requirements, it is advised to refer to the Join Sherpa website.