Insurance is crucial for all your trips. Today, we will provide information about Safe Travel LATAM to assist you in making the best decision.

LATAM Travel Insurance is available to airline customers and is associated with a leading travel insurance company. If you’re questioning its value, you’ve come to the right spot.

We have created this post to provide key information about LATAM Travel Insurance plans in order to help you choose the perfect one for your trip. We will also introduce a potentially more beneficial alternative. Keep scrolling to find out more! 😉

In this article you will find:

- What does LATAM Travel Insurance involve?

- Is LATAM Travel Insurance trustworthy?

- LATAM’s Safe Travel on Reclame Here

- How to enlist travel insurance for Latin America.

- What types of insurance coverage does Travel LATAM offer?

- How to get in touch with LATAM Travel Insurance

- Is it worthwhile to invest in LATAM Travel Insurance?

- What is the most secure journey?

- Safe travel discount voucher

- How to select a secure budget-friendly travel option

- What does travel insurance include?

- Types of insurance for traveling

- Top Insurance Companies

- FAQs

What does LATAM Travel Insurance entail?

LATAM Travel Insurance is a policy associated with the airline and accessible to passengers who purchase tickets through LATAM or are members of the LATAM Pass mile program. Customers can easily purchase the insurance at the time of booking or shortly thereafter through their account.

Is the reliability of LATAM Travel Insurance trustworthy?

Latam Travel Insurance can be considered trustworthy because it is provided by Chubb Travel Insurance, a well-established brand with a strong reputation and extensive experience in the market. Operating in 54 countries, including Brazil where it is registered under CNPJ 03.502.099/0001-18 and authorized by SUSESP.

Chubb collaborates with popular insurance firms like Affinity, GTA, and Universal Assistance, all of which are part of Secure Promo, the biggest online platform for selling travel insurance. These companies also manage the travel insurance plans provided by airlines like LATAM.

Compare multiple travel insurance plans available in Insurance Promo.

LATAM’s Safe Travel on Reclame Here

LATAM Travel Insurance does not have a dedicated page on Reclame Aqui. However, we can assess the LATAM and Chubb pages separately. It’s important to note that the complaints for each company differ as neither focuses solely on secure travel.

Both companies are well-regarded on the platform, receiving a rating of 7. However, it is currently challenging to assess issues specifically related to the plans that were signed up for. The majority of complaints against LATAM pertain to refund issues, while most complaints against Chubb involve reimbursement matters.

Many consumers are dissatisfied because they were unaware that Chubb Travel Insurance could be used for refunds. To prevent this issue, it is crucial to thoroughly read your policy to understand all the protections and limitations of the selected plan.

How to recruit Latin America Travel Insurance

To purchase LATAM Travel Insurance, you need to be a member of the LATAM program Pass or have bought your flight tickets. Then, simply provide your registered CPF or input the booking code from the ticket, accessible in the customer section of the company’s website or the LATAM Airlines app.

The platform provides various plans depending on where you’re going, allowing you to select the most suitable one after reviewing the options. It’s essential to carefully check the policy to understand the specific terms and conditions.

You will then be emailed the document containing all the details of the plan. If you change your mind about the purchase, you can request a cancellation within 24 hours to receive a full refund of the insurance payment.

What insurance options does Travel LATAM offer?

Five travel insurance plans are offered by LATAM on their website, providing standardized coverage such as medical expenses, accidental death, lost luggage assistance, flight cancellation, and a 24-hour service center in Portuguese.

Each of the plans mentioned includes different options known as “sub-plans” with varying coverage values and availability. Once you choose your initial destination, you will see a table displaying all the available alternatives.

- Domestic travel insurance is designed for national travel.

- Latin America is covered for travel, including South America, Central America, and Mexico, but excludes Cuba.

- United States and Canada are detailed with expanded coverage as a secure journey to North America.

- Europe offers a secure journey with the necessary standards set by the Schengen Treaty.

- More parts of the globe – designed for alternate locations lacking a dedicated strategy, like global travel coverage.

LATAM Travel Insurance only provides coverage for transportation and medical expenses and does not include pre-existing conditions in any of its plans. All plans cover travelers up to 85 years old.

How to get in touch with LATAM Travel Insurance

To reach LATAM Travel Insurance while abroad or in Brazil, you can dial the chargeable phone number +55 (11) 3526-8714 for 24/7 medical assistance provided in Portuguese.

To activate the insurance, you need to provide:

- Title

- Social Security Number

- Birth date

- Insurance Ticket Identifier

It is useful to keep insurance documents readily available, either on your phone or in printed form, for quick access to the necessary information to activate LATAM Travel Insurance.

Is it worth investing in LATAM Travel Insurance?

While it may appear straightforward to purchase, it’s important to note that the LATAM Travel Insurance may not offer the best value. Opting for travel insurance is advisable, but it’s worth considering other more comprehensive and cost-effective alternatives available.

Having a secure journey is typically beneficial, providing peace of mind and protection against potential complications like medical emergencies and baggage issues. Travel insurance is essential for certain destinations, such as countries within the Schengen Area in Europe.

LATAM Travel Insurance offers limited coverage compared to other options available through Chubb Travel Insurance, such as Affinity, GTA, and Universal Assistance. It is advised to explore alternative options for more comprehensive coverage at better rates.

Discover the Promo Insurance platform to get discounts on your preferred insurance package.

What is the optimal secure journey?

When determining the ideal safe travel option, it is crucial to take into account the unique characteristics of the traveler. It is important for travel insurance to provide services that cater to these specific needs for all types of travelers.

It’s important to have essential services for a smooth journey, such as safe travel for lost baggage, comprehensive pharmaceutical coverage, and assistance in case of document loss. The best travel insurance is one that provides the necessary support tailored to your needs. This is why LATAM Travel Insurance may not be the most suitable option due to its limited coverage.

You must be curious about how to find safe and perfect travel now, right? It’s actually easier and quicker than you think. 😉

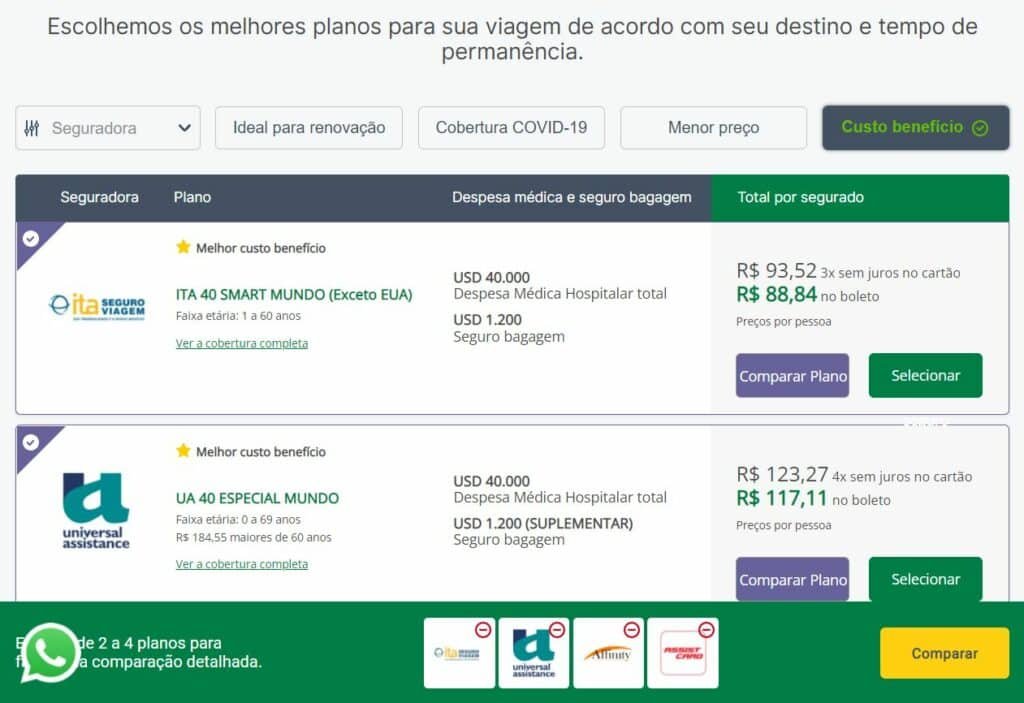

It is possible to obtain travel insurance quotes for various plans covering all continents and audiences through the online insurance comparison tool. Promo Insurance platform collaborates with leading companies in the market, offering highly competitive prices.

By utilizing the platform, you can explore a wider selection of choices and select an insurance plan that meets the specific needs of your trip. This way, you can have a more relaxed and secure experience away from home, knowing that you will receive the necessary assistance to address any unforeseen circumstances.

Explore all the travel insurance choices offered by Secure Promo here.

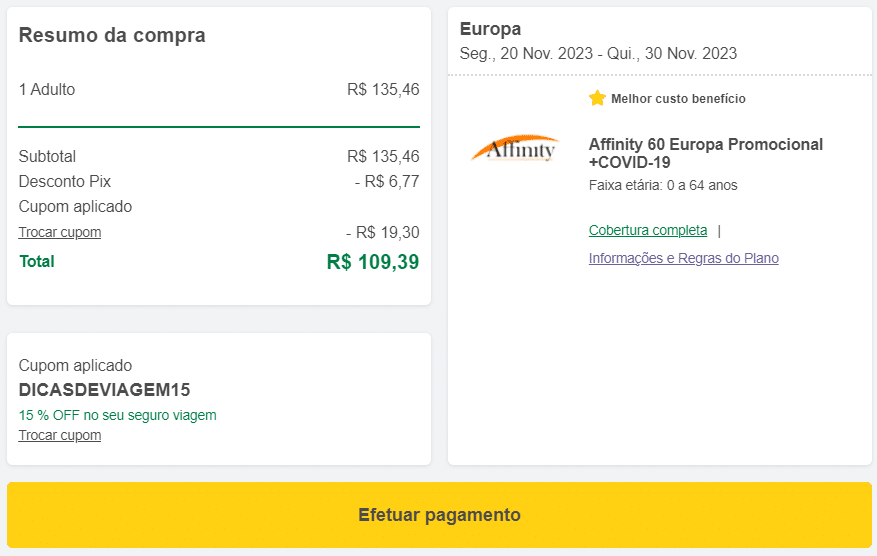

Coupon for a discounted rate for secure traveling

Travel Tips readers can access a discount coupon for Promo Insurance by using the code DICASDEVIAGE15 to receive a 15% discount on the total price. Sounds good, right?

Customers can enjoy additional 5% savings by using billet, Pix, or transfer as payment methods, with the discounts being cumulative. This means you can save up to 20% on your travel insurance. Additionally, insurance purchases can be paid in installments of up to 12x for added convenience.

- Click to use the coupon code DICASDEVIAGE15 and receive a 15% discount.

- Earn an additional 5% and enjoy a total discount of 20% by paying with billet, Pix, or through a transfer.

How to employ a secure reduced-rate travel service

Hiring secure travel is easy and can be done online. Promo Insurance is a highly recommended insurance comparison website that provides detailed information on the top insurance plans available to assist you in making a decision.

Choose the desired continent on the homepage, enter the departure and arrival dates, provide your name, email, and phone number, and then click on “search safe travel.”

You will be guided to a list of available insurance options for your destination. To compare, select two to four plans and choose the “compare plane” option. Next, click the “compare” button on the bottom right of the screen. This allows you to view the benefits of each insurance side by side for decision-making and finalizing the purchase.

What does travel insurance include?

Travel insurance typically includes coverage for certain aspects like medical emergencies, hospitals, and medical transfers in a standard manner. However, the extent of coverage may vary based on the specific insurance plan selected from the company.

When selecting travel insurance, remember that the fundamental coverage options include:

- Medical, hospital, or dental care is available 24 hours during international travel.

- Regression analysis

- Medical Transportation

- Body transfer and death coverage during travel

- Accidental injury leading to complete disability while traveling

- Unintentional fatality

You can also include additional protective covers for your safe journey.

- Help for Covid-19 and global health crises

- Travel cancellation: Canceling a trip

- Returned prematurely due to an accident

- Baggage fees for lost or damaged items

- Accidents in extreme sports

- If hospitalized

- Expecting a baby

- Cell phone theft or robbery

- Failure and costs associated with legal matters

After identifying the desired plan on the online insurance comparison tool, ensure to review the selected option’s policy and verify that the services are provided by reputable insurance firms.

Find out which secure travel option is best suited to your requirements.

Types of insurance coverage for traveling

There are various types of travel insurance available for different travel preferences. Find more information on each type in our detailed guides. Check them out.

- International travel insurance coverage

- National travel insurance

- Travel safely while pregnant.

- Safe journey for senior citizens

- Sea cruise for safe travel

- Safe multiple journeys

- Safe travel to multiple destinations

- Annual travel insurance

- Exchange of travel safely

- Student Travel Insurance

- Safe skiing and snowboarding trips

- Safe transportation of infants

Discover Insurance Promo to find the ideal travel insurance for your upcoming journey.

Top Insurance Companies

There is a vast array of insurance options in the market, which can be overwhelming. To help navigate through the choices, we have created a guide outlining the key insurance plans. Check out our articles for details on insurers’ backgrounds, plan offerings, and reputations on platforms like Reclame Here.

- Closeness or connection

- Card to observe

- Coris Safe Travel

- Trip Watching

- Ensure a secure journey.

- Paraphrase: Grand Theft Auto

- Intermac Support

- Vital Card

- ITA Travel

- Travel Assistance

- Universal Aid

- My Travel Help

- Insurance as well

Explore all available travel insurance choices.

FAQs

LATAM Travel Insurance offers limited plans compared to other Chubb partners like Affinity, GTA, and Universal Assistance.

LATAM Travel Insurance’s reputation on Reclame Here is not easily discernible, as there is no dedicated page for the company. However, both LATAM and Chubb, a reputable travel insurance provider, have positive reviews on the platform, albeit within a broader range of products and services.

LATAM Travel Insurance can be purchased by customers who have purchased an airline ticket or by travelers who are members of the LATAM Pass mile program.

LATAM Travel Insurance typically costs around R$ 30 per day. It’s essential to note that this amount needs to be included in the overall expenses of the LATAM flight ticket, as safe travel is connected to the journey.

Depending on the plan, LATAM Travel Insurance may include coverage for covid-19, but in some cases, it may require additional purchase.

LATAM Travel Insurance includes body repatriation, repatriation of remains, medical costs, hospital expenses, lost luggage, and round-the-clock emergency assistance in Portuguese.

The Chubb trip safe is dependable, with a presence in 54 countries and 120 offices across 29 countries, including Brazil. Chubb operates under CNPJ 03.502.099/0001-18 and is registered in SUSESP (Superintendence of Private Insurance). Explore the travel insurance choices offered by Chubb.

Travel Tip Readers can save 15% on any plan at Promo Insurance by using the discount code DICASDEVIAGE15. Additional savings of up to 20% can be applied when paying with Pix, by transfer, or using the billet.