One essential aspect of traveling to Europe is ensuring safe and cost-effective transportation that meets the traveler’s needs. If you’re looking for tips on finding the perfect travel plan, this guide has you covered!

Traveling to Europe is a fantastic option, offering stunning cities and incredible sightseeing opportunities. Whether you’re a fan of history, culture, the seaside, landscapes, walking tours, or delicious food, Europe has something for everyone. However, it is important to have reliable travel insurance when visiting the continent.

In addition to being a mandatory requirement for entering European territory, insurance can assist with various issues that may arise during a trip. It can provide assistance with lost luggage or medical emergencies, helping to minimize inconveniences without requiring any additional payments beyond the plan cost.

If you are uncertain about traveling safely in Europe or need assistance choosing the most suitable option for your trip, you’ve come to the right place. We offer recommendations for the best ways to travel safely in Europe, explain the process, and even provide a discount coupon to help you secure the best price for your safe travels.

Are you curious? Scroll the screen to discover all the details. 😉

In this article, you will find:

- What is the most secure way to travel in Europe?

- Table comparing the top plans

- How expensive is a secure journey to Europe? Reduced prices for secure travel.

- Coupon offering a discount for secure travel

- Is it mandatory to travel safely in Europe?

- What does the Schengen Treaty entail?

- What is the least amount of insurance needed for traveling to Europe?

- How to ensure a secure journey to Europe?

- How can I get in touch with the insurance company?

- Why invest in a secure European travel experience?

- Which secure travel option should I select?

- What types of insurance coverage are available for traveling in Europe?

- What is not included in the insurance for traveling to Europe?

- What is the functioning process of travel insurance in Europe?

- How to initiate secure travel

- What types of travel insurance are available?

- I’m sorry, but I didn’t receive any text from you to paraphrase. Could you please provide me with the text you would like me to paraphrase?

- Does Safe Travel Europe provide coverage for the coronavirus?

- Does the travel insurance provided by credit cards work in Europe?

- Is it possible for me to utilize PB4 in place of safe travel Europe?

- Top Insurance Companies in Europe

- Europe’s Internet Chip

- Commonly Asked Questions

- Coupon offering a discount for traveling safely

Which is the top safe way to travel in Europe?

The Affinity 40 Essential Europe +Covid19 is a top choice for secure travel in Europe. It is affordable, provides extensive coverage, and is a popular option on online insurance comparison websites. This plan even includes coverage for pregnant travelers.

Other excellent options include the ITA 60 Europe and the New UA 150 Europe plans. The ITA 60 Europe plan is more budget-friendly, whereas the New UA 150 Europe plan offers comprehensive coverage for those seeking higher medical-hospital expenses coverage.

For exchange students traveling in Europe, the top recommended travel insurance option is the GTA 100 STUDENT FULL EUROPE COVID-19 +TELEMEDICINA, providing specialized coverage.

The insurance plan called Hero 30 Europe + Telemedicine Albert Einstein +75 is specifically designed for travelers over the age of 75, with a focus on benefiting elderly individuals. This insurance company also offers plans for older individuals up to the age of 99.

For individuals who value coverage for lost luggage (as the European continent has a high incidence of this issue), a helpful suggestion is to consider the AC 500 EUROPE (U.S. except) COVID-19 plan, which includes €2,000 in lost luggage insurance.

If you are planning to travel with your pet and want to make sure there is also assistance available for your pet, the best option is the Hero 30 Europe + Telemedicine Albert Einstein. Along with $500 worth of veterinary assistance, it provides coverage of $30,000 for humans.

Next, we provide information on the top travel insurance options for Europe that are discussed in this article.

Top insurance option for essential coverage.

Description: Affinity 40 Essential Europe +Covid19 provides €40,000 coverage for medical expenses and €500 for baggage insurance. It includes coverage for sports and dental emergencies, a pharmaceutical refund of €400, and covers pregnant women up to 32 weeks. View prices for more details.

Top insurance option for the best price.

Text: ITA 60 Europe (excluding U.S.) + Telemedicine Albert Einstein – Provides coverage for €60,000 in medical-hospital costs, €2,250 in baggage insurance, and up to €4,000 for accidents during sports activities. It includes €250 for both physiotherapy and medication reimbursements. – VIEW PRICING

Top-tier comprehensive insurance coverage.

New UA 150 Europe (excluding the USA) offers coverage of $150,000 for medical and hospital expenses along with $1,500 for baggage insurance. It includes coverage for pregnant women up to 28 weeks, accidents during sports practice within the DMH, and dental emergencies up to $1,500. Check out the prices for more information.

Table comparing the top plans

If you prefer visual information, refer to the table below to compare the advantages of each insurance plan. Use it to help you select the most suitable option.

| Insurance | Affinity | ITA Safe Travel | Universal Assistance |

| Plan | Affinity 40 Essential Europe +Covid19 | ITA 60 Europe (except USA) +Telemedicina Albert Einstein | New UA 150 Europe (except USA) |

| Medical and hospital expenses | € 40 thousand | €60,000 | $ 150 thousand |

| Medical cover for sports | In DMH | € 4 000 | Inside the DMH |

| Coverage for pregnant women | Inside DMH – Up to 32 weeks | No | Inside DMH – Until 28 weeks |

| Telemedicine | Yeah. | Yeah. | Yeah. |

| Dental cover | In DMH | €200 | $1,500 |

| Pharmaceutical cover (for refund) | € 400 | € 250 | $1,500 |

| Medical expenditure by covid-19 | In DMH | € 10 thousand | In DMH |

| Regression | € 20 thousand | € 10 thousand | $15,000 |

| Flight delay costs | No | € 200 (12 hours) | $300 (6 hours) |

| Luggage Location Assistance | No | No | Yeah. |

| Damage to the bag | No | € 150 | No |

| Extraviated baggage insurance | € 500 (complete) | € 1.250 (complete) | $1,500 |

| Legal assistance by traffic accident | €5,000 | €500 | $1,000 |

| Pet Assistance | No | No | No |

| Insurance value | $ 9,47 (per day) | $ 12,12 (per day) | $ 23,66 (per day) |

View additional information or explore alternative insurance options on the online comparison tool.

What is the cost of a secure journey to Europe?

Text: Traveling safely in Europe can cost less than R$ 10 per day. You can easily compare online insurance prices for your trip dates. 😉

It is important to note that the insurance coverage amount can differ based on the individual purchasing the service or the activities being undertaken. For instance, an older individual may have a more costly travel insurance plan compared to a 25-year-old, and a extreme sports enthusiast may also require a more expensive policy.

The insurance is affordable and provides great value by offering peace of mind during the trip. It reduces worries about handling emergencies, as you can simply contact the insurer for assistance.

Paraphrased text: When you prioritize safe travel, you are acknowledging the importance of being prepared for unforeseen circumstances, even though you hope you won’t have to rely on it. Nevertheless, having that safety net in place is crucial in case of any unexpected events.

Explore all the secure travel choices available in Europe.

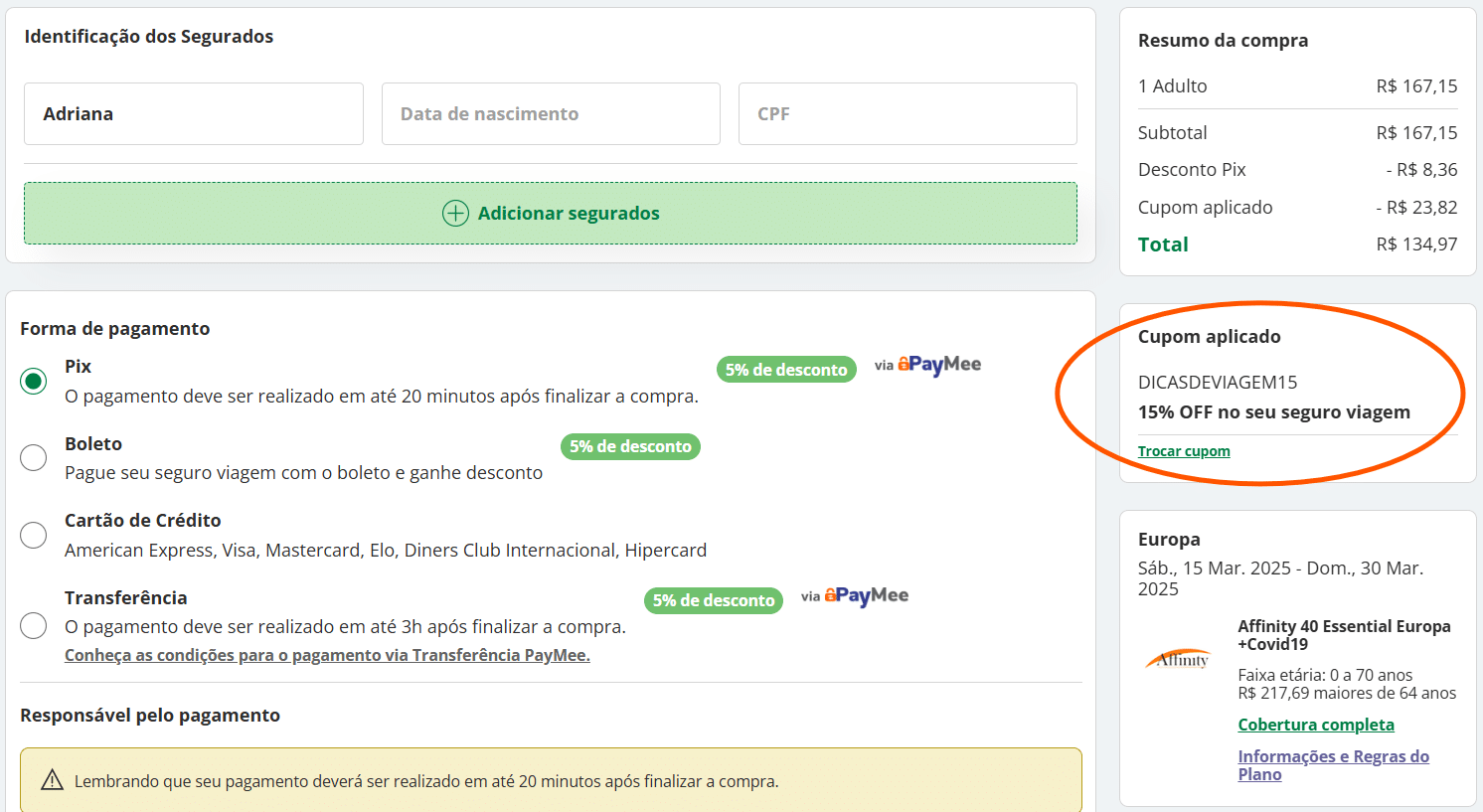

Coupon for discounted travel safety measures.

Text: Instead of just having coverage for emergencies while traveling, it’s more beneficial to purchase insurance at the most competitive price available. To take advantage of this, our readers can use the code DICASDEVIAGE15 on the online insurance comparison platform to receive a 15% discount on the total cost.

Those who make payments using boleto, PIX, or bank transfer will receive an additional 5% discount, which can be combined with any existing discounts. This means you could save up to 20% on booking your secure trip to Europe.

Additionally, it is important to note that insurance purchases can be divided into monthly installments of up to 12x, making payments much easier.

- Click on the link to use the coupon code DICASDEVIAGE15 and receive a 15% discount.

- Make a payment through billet, Pix, or transfer to receive an additional 15% discount and save up to 20%!

Explore the various secure travel choices available in Europe.

Is travel safety mandatory in Europe?

Yes, travelers visiting Schengen countries are required to have Europe travel insurance, so it is important to purchase a plan that complies with the agreement’s specifications.

The Treaty stipulates that travel insurance must provide a minimum of 30,000 euros in medical or hospital coverage (or the equivalent in dollars). Furthermore, it must include provisions for repatriation in case of medical emergencies, medical evacuation, and repatriation of remains in the event of the traveler’s death on the continent.

The insurance coverage amount serves as protection for the individual in case of any medical or legal issues during their stay. Additionally, individuals traveling to Europe without proper travel insurance may face deportation by the authorities. It is advisable not to take that risk.

Brazilians holding dual citizenship, including European citizenship, are not required to have travel insurance, but it is still advisable to purchase it. The insurance covers health expenses without any out-of-pocket costs as long as the expenses are within the coverage limits. Additionally, the insurance provides various forms of assistance beyond just medical support.

Explore the various secure travel choices available in Europe.

What does the Schengen Treaty entail?

The Schengen Treaty is a pact among European nations that enables unrestricted travel between them, allowing for easier border crossings within the Schengen area.

For travelers, this agreement means they must ensure they have a secure journey with medical insurance covering a minimum of 30,000 euros for hospital expenses. In certain plans, amounts may be in dollars, in which case coverage should be equivalent to 30,000 euros. Therefore, it is important to carefully select a plan that offers this level of coverage and verify that it meets the requirement.

There are 27 countries that have signed the Schengen Treaty, including Germany, Austria, Belgium, Croatia, Denmark, Slovakia, Slovenia, Spain, Estonia, Finland, France, Greece, Netherlands, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Poland, Portugal, Czech Republic, Sweden, and Switzerland.

Romania, Bulgaria, and Cyprus are currently in the process of implementing the Schengen Treaty. The United Kingdom (England, Scotland, Wales, and Northern Ireland) and Ireland are not included in the Schengen Treaty.

What is the least amount of insurance needed for traveling to Europe?

In order to travel to Europe, the travel insurance must provide coverage of at least 30,000 euros or the equivalent in another currency. Any insurance plan that offers less coverage for medical and hospital expenses is not suitable for travelers visiting Schengen countries.

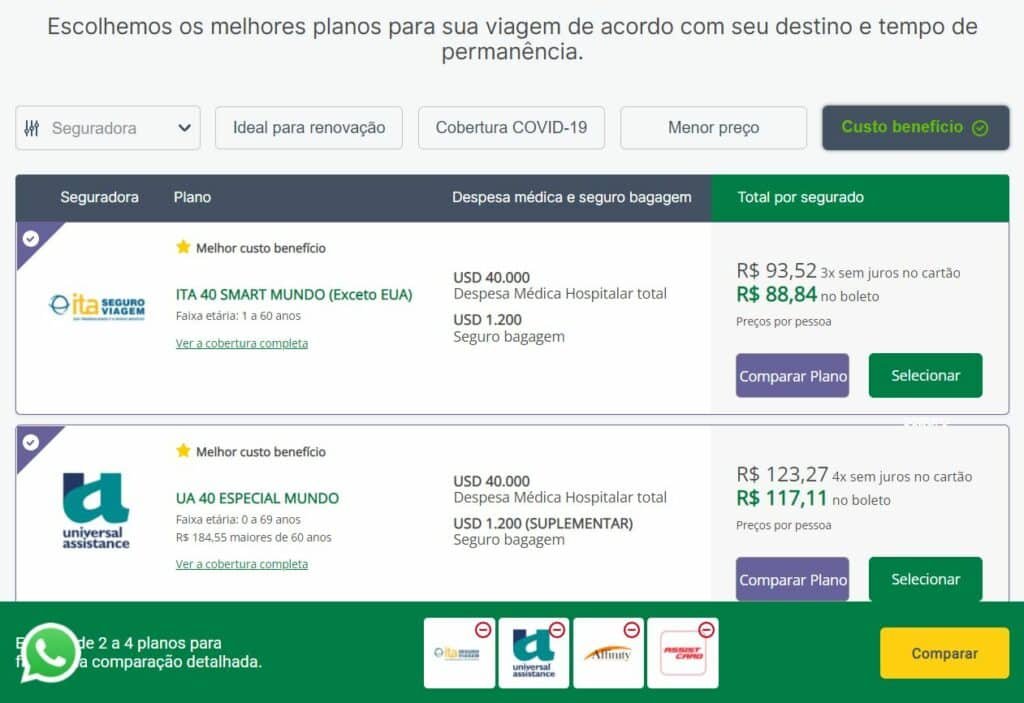

Hence, it is highly recommended to utilize the online insurance comparison tool to discover the perfect travel plan for your trip to Europe. By selecting the destination and filtering the options by continent, the website exclusively displays insurance plans accepted in European countries. This ensures that you will only view suitable plans tailored to your European trip.

Utilize the comparator to guarantee the correct selection of a safe travel option in Europe.

How can one ensure a secure journey to Europe?

It’s easy to hire travel insurance for Europe online. Promo Insurance is a highly recommended comparison website that brings together the best insurance plans on the market, making it easier for you to choose.

For a secure journey in Europe, simply adhere to these steps:

- Access the comparison tool for travel insurance online.

- Choose the continent you are traveling to on the main page, enter the dates of departure and arrival, and provide your name, email, and phone number.

- Click on the “search safe travel” button to access a page displaying the list of available insurance options.

- Select between two and four options by clicking the “compare plans” button.

- After choosing specific plans, select the “compare” button located at the bottom right corner of the screen.

- Sure! Now you can compare the details of each insurance policy side by side to make a more informed decision.

After enrolling in the plan, you will be sent the insurance policy by email. This document is crucial and should be kept in a readily accessible place. It contains the overall terms of the insurance you have chosen as well as instructions on how to contact the insurer in case of an emergency.

How can I get in touch with the insurance company?

If there is an emergency during the trip, you can reach out to the insurance company through phone, WhatsApp, online chat, or email. The policy contains all the necessary contact information, so make sure to keep it easily accessible at all times.

It’s important to note that all the insurers featured on Promo Insurance offer round-the-clock assistance in Portuguese. This means that even if you’re in France, you can receive service in your native language with the travel insurance coverage for France.

Explore all the secure travel choices available in Europe.

What is the reason for purchasing a secure Europe travel option?

The European travel insurance is not only mandatory within the Schengen area but also beneficial for a hassle-free journey. It is a requirement for gaining entry and moving around the countries in Europe, offering additional advantages.

One of them follows along with the pocket, dealing with any issues that may arise outside. For instance, if you’re injured and require medical treatment, the insurance will recommend a suitable hospital and pay for all expenses. You won’t need to pay anything extra as long as the costs are covered in the plan.

In other situations, European travel insurance can provide assistance when needed. If you lose a document, experience lost luggage, encounter car troubles, or are in a traffic accident, insurance can offer legal aid and support. Additionally, the Brazilian government advises obtaining insurance coverage for these unforeseen circumstances.

We sincerely hope that no one has to resort to safe travel measures, but having insurance provides invaluable peace of mind, particularly during challenging times. Furthermore, insurance is an affordable investment, especially when considering the costs incurred during emergencies.

Our suggestion is to hire the top-rated safe travel service in Europe that aligns with your needs to avoid these issues.

Explore the various secure travel choices available in Europe.

Which safe travel option should I select?

To discover the most suitable travel insurance for your safe travels in Europe, a useful suggestion is to utilize the travel insurance comparison tool. The website offers a variety of choices, and we will provide some guidance to assist you in selecting the most appropriate plan.

Firstly, consider the cities you plan to visit. Organize your itinerary and consider the specific details that could enhance your trip. Here are some questions to help guide you:

- What activities do you plan to engage in?

- Are extreme sports (such as surfing, skydiving, and diving) included in the plan?

- Are you currently pregnant or could you be pregnant?

- Is there a possibility that the trip might be called off for any reason?

- Would you like coverage in case your luggage is lost?

- What is the maximum age limit for coverage in certain plans (some plans only cover individuals aged 70 and above)?

- Is your trip of a long duration?

- Do you plan on making an exchange?

After conducting this evaluation, you can compare the plans offered by different insurance companies and assess the coverage provided for each aspect. The online comparison tool allows you to compare up to four plans simultaneously and identifies the most cost-effective options, making it simpler to select a plan that fits your budget.

Explore all the secure transportation choices available in Europe.

What types of insurance coverage are available for traveling in Europe?

Travel insurance typically includes coverage for certain standard items like medical emergencies. However, there are also more extensive plans available for individuals with greater risks, unique needs, or specific coverage requirements.

If you encounter any transportation issues, such as traffic delays, you can ensure safe travels by utilizing a travel support service with legal backing. The level of assurance provided varies based on the type of insurance you opt for, which can range from basic to comprehensive coverage.

The typical situations that safe travel insurance includes are:

- Medical, hospital, or dental care available 24/7 during international travel.

- Paraphrase: The act of returning someone to their home country.

- Transporting patients for medical purposes.

- Transfer of the body and insurance for death during travel.

- Complete disability as a result of an accident while traveling

- Legal and financial support

- The passing away or severe sickness of a family member

There are additional covers available for rent to ensure a safe journey.

- Assistance for COVID-19 and global health crises.

- Travel cancellation can be defined as the act of terminating or abandoning travel plans.

- Accidental early return

- Costs for luggage that is lost or damaged

- Text: Incidents occurring during extreme sports

- Delay in the departure of a flight.

- Expecting a baby

Explore the various secure travel choices available in Europe.

What types of incidents are not included in European travel insurance coverage?

Despite the extensive coverage provided by travel insurance, there are certain situations not covered by even the most comprehensive plans. These exceptions typically involve illegal activities and are directly related to the behavior of the traveler, leading to a justified loss of insurance coverage.

Certain conditions are not included in the coverage provided by Safe Travel Europe.

- Alcohol-related traffic incidents

- Issues resulting from the consumption of illegal substances

- Brigades or riots instigated by the policyholder.

- Issues resulting from natural calamities

- Pandemics or epidemics – unless the plan offers detailed coverage, such as plans that cover Covid-19.

- Health issues stemming from pre-existing conditions that were not disclosed to the insurance company when the policy was taken out.

In other words, travel insurance mostly applies to travelers who adhere to the usual laws. If you are responsible, you shouldn’t have any concerns.

In every situation, it is crucial to thoroughly read the entire policy and ask any questions to the insurance comparison representatives before buying. If you anticipate encountering certain circumstances during your trip, you can verify with them whether the insurance you selected covers you.

Explore the various secure travel choices available in Europe.

What is the process for using travel insurance in Europe?

Safe travel is a service that offers medical support for travelers overseas, as well as assistance in legal matters and the option for either help or reimbursement.

The online comparison tool provides immediate assistance options when required. Here’s how it works: if an emergency arises, you can reach out to the insurance provider who will guide you on necessary actions to take, such as directing you to a specific hospital. The insurance plan also covers related costs in accordance with the selected coverage amount.

Insurance policies that offer reimbursement typically require you to first seek treatment from a healthcare provider before making a claim. You will need to provide receipts and invoices to be reimbursed for the expenses incurred. This is especially common with travel insurance that is tied to a credit card.

Explore all the secure transportation choices available in Europe.

How to initiate secure travel

To ensure safe traveling, you can easily contact your insurance company’s phone number for free from any location worldwide. The service is always available in Portuguese. Additionally, some insurance companies offer mobile apps that make communication even easier.

Inform the attendant about your issue, and they will provide you with the required assistance to address the situation. It is crucial to remain composed to comprehend the instructions and successfully navigate the situation.

Save the policy in a convenient location for easy access to contact information. It is important to thoroughly read the entire document and comprehend the specifics of the plan you have chosen.

If you struggle to communicate with the insurance company, don’t hesitate to ask for assistance. The key is to access the services you require. Keep all receipts and then reach out to the company to address any financial concerns.

Explore the various secure transportation choices available in Europe.

What kinds of travel insurance are available?

Text: Various travel styles have insurance coverage available. We outline the most popular types below, with detailed guides providing more information on each type’s specific features.

- Travel insurance for trips abroad

- Credit Card for Traveling Safely

- Text: Ensuring a secure journey for expectant mothers.

- Ensuring the safety of elderly travelers.

- Secure Ocean Voyage Experience

- Secure multiple journeys.

- Annual travel insurance

- Text: Ensuring the safety of student travel

- Secure exchange of travel arrangements

- National travel insurance

Explore the various secure travel choices available in Europe.

I’m sorry, but it seems like you forgot to provide any text for me to paraphrase. Could you please provide the text you would like me to paraphrase?

Besides having travel insurance, another necessary document for entering Europe is ETIAS, a travel authorization that will become mandatory for Brazilian travelers starting in 2025.

The abbreviation ETIAS originates from the English phrase European Travel Information Authorization System, which can be loosely translated as European Travel Authorization Information System.

Even though it’s an additional step in trip planning, applying for ETIAS is a simple and cost-effective process. The application is submitted online for a fee of 7 euros per person, and applicants typically receive a response via email within two days. Pretty convenient, right?

For the next hour, there is no need to be concerned about ETIAS as it is not yet in place. Once we receive updates on this matter, we will revise the post with all the relevant details. 😉

Explore all the secure travel choices available in Europe.

Does Safe Travel Europe provide insurance coverage for coronavirus?

Certainly! Some travel insurance plans for trips to Europe include coverage for medical expenses related to covid-19, but not all of them do.

To guarantee that you have travel insurance coverage in case you test positive for covid while abroad, search for plans that specifically mention this. This detail is often included in the title of the insurance product, as shown in the examples above. Nevertheless, it is important to carefully review the policy and address any questions before making a purchase.

You can also search for a safe journey with Covid-19 coverage by utilizing the online insurance plan comparison tool.

You can compare the different insurance options offered by each company and select the one that best suits your needs.

Does credit card travel insurance function in Europe?

Yes, travel insurance provided by credit cards is also applicable for individuals traveling to Europe.

Anyone who possesses a credit card that includes travel insurance, typically activated by purchasing a ticket with the card, can utilize this insurance to meet the entry requirements for travelers on the continent.

It is sufficient to meet the basic criteria outlined in the Schengen Agreement. This includes having a travel insurance card with a minimum coverage of 30,000 euros, as well as coverage for medical repatriation, medical evacuation, and repatriation of remains.

Explore all the secure transportation choices available in Europe.

Which option is preferable: using card insurance or purchasing a separate policy?

The response to that inquiry is that it varies. When weighing the benefits of using a secure credit card for travel versus purchasing dedicated insurance, there are multiple factors to take into account.

If your card insurance only provides the basic coverage required for entry in Europe, but you are not confident in its reliability and would prefer a more extensive and comprehensive policy, obtaining additional travel insurance specifically for Europe is the optimal choice. Various plans with different coverage levels are available through online insurance comparison tools.

Alternatively, if you find the benefits offered by the card appealing, you can rely on it. It is recommended to check reviews and complaints about this service on Reclame Here to gain a better understanding of the company’s performance as an insurance provider.

Explore all the secure travel choices available in Europe.

Is it possible for me to utilize PB4 in place of safe travel Europe?

It is important to note that PB4 cannot be used as a substitute for travel insurance, as it is only valid in Portugal.

This is due to the fact that the PB4 only grants Brazilian tourists entry to the Portuguese healthcare system. In Portugal, healthcare services operate under different conditions compared to Brazil. These services are not entirely free (they may cost between 5 to 20 euros) and, apart from the cost, the PB4 does not offer other essential coverage as mandated by the Schengen Treaty.

This means that relying solely on PB4 is not enough to enter Portugal, so it’s important to purchase travel insurance for a safe trip to Portugal. Additionally, when traveling to other European countries, it is still necessary to have mandatory travel insurance with at least EUR 30,000 coverage.

It is important to note that the same reasoning also applies to IB2, a certification equal to PB4, but used in Italy rather than Portugal.

Explore all the secure travel choices in Europe.

Top Insurance Companies in Europe

Many people looking for safe travel in Europe often wonder which insurance company is best suited for their needs. With numerous companies in the market, we offer guides on the leading ones to assist you in finding the perfect insurance plan.

Read our articles to discover more about the background of each insurance company, the types of plans they provide, and even their reputation on Reclame Aqui.

- Can you please provide the text that you would like me to paraphrase?

- Card Watch

- Coris Safe Travel can be rephrased as Coris Travel Safety.

- Trip Watch

- Ensure a secure journey.

- Text: Grand Theft Auto

- Intercam Support

- Vital Card – Essential Card

- ITA Travel Text

- Text: Traveling Assistance

- Assistência Universal

View additional information or explore alternative insurance options on the online comparison tool.

Europe’s Internet Chip

How about staying connected to the internet throughout your entire season in Europe with international travel chips? This is now feasible at great prices that won’t break the bank. Explore the deals from America Chip and ensure seamless internet usage in Europe. Don’t forget to take advantage of our America Chip discount coupon. – VIEW PRICES

Commonly Asked Questions

Do you still have questions about something? Then take a look at the main questions our readers have about safe travel in Europe below.

Safe Travel Europe offers a specialized service for travelers exploring Europe, ensuring access to medical or legal assistance in case of any issues during their trip. Explore the various travel insurance plans available for Europe.

The top recommended travel insurance options for a safe trip to Europe are the ITA 60 Europe (excluding USA) with Telemedicine Albert Einstein, the Affinity 40 Essential Europe with Covid19 coverage, and the New UA 150 Europe (excluding USA). Explore additional insurance plans available for Europe.

There are very affordable options available for traveling safely to Europe. The most cost-effective choice is the Affinity 40 Essential Europe +Covid19 plan, starting at just R$ 9 per day. Be sure to explore other budget-friendly options as well.

Text: One benefit of European travel insurance is the affordable cost of the plans. You can get a quality insurance for under R$ 10 a day, which can help you save money on unexpected expenses while traveling abroad. Check out the available plans.

It is necessary to have travel insurance for a safe journey to Europe because most European countries are part of the Schengen Treaty, which mandates insurance for travelers. Failure to provide insurance may result in the risk of being deported. Make sure to have insurance before traveling to Europe.

In countries that are part of the Schengen Treaty, individuals who are caught traveling without proper documentation are sent back to their home country. It is not advisable to take this risk, especially considering the affordable travel options available. Make sure to ensure a safe journey when traveling to Europe.

Yes, travel insurance is required for individuals visiting Europe, unless they hold European citizenship. If you are a Brazilian citizen and want to avoid the risk of deportation, it is necessary to purchase a travel insurance plan for Europe. Check out the available plan options.

For safe travel in Europe, it is necessary to have insurance that provides at least 30,000 euros in coverage for medical expenses, as well as benefits such as health repatriation, medical evacuation, and repatriation of remains. Please review available insurance plans for Europe.

Safe travel Europe includes coverage for medical and hospital expenses (HDM), repatriation of remains, medical evacuation, as well as additional benefits like dental, prescription, and physical therapy costs. Explore the available plan choices for Europe.

Certainly, you can only be covered for Covid cases if you choose a plan that includes coverage for Covid. One example is the Affinity 40 Essential Europe +Covid19 plan. I recommend looking for plans that specifically mention Covid-19 in their name.

You are not required to purchase insurance that includes coverage for Covid, but many European plans offer this as an additional benefit. Check to see which plans include Covid coverage.

The insurance policy does not provide coverage for accidents caused by travelers who are under the influence of alcohol or drugs, carrying weapons, or behaving recklessly. Make sure to familiarize yourself with the policy guidelines to ensure you are eligible for insurance coverage. Explore the safe travel options available for purchase in Europe.

To cancel the travel insurance, you must get in touch with the insurance company and ask for cancellation. It is important to note that you should make this request at least two days before the plan expires (departure date). After this deadline, it is no longer possible to cancel the travel insurance.

It varies by insurance company. Certain travel insurance policies permit trip extensions, meaning you can request a renewal if you need to extend your stay at the destination. Check which insurance plans for Europe provide this option.

To prolong your travel insurance coverage, get in touch with the insurance provider and request an extension of your policy. This must be done at least two days before the policy expires and is dependent on the insurance company’s approval. Check which plans offer continuous coverage.

Brazilians with European citizenship can enter Europe without needing travel insurance and can access public healthcare with the European Health Insurance Card (EHIC). However, this service may not always be free, so it is still recommended to have travel insurance for Europe.

Each country within the Schengen area mandates secure travel for visitors. There are a total of 27 countries in the area, such as Germany, Austria, Belgium, Denmark, Slovakia, Slovenia, Spain, Estonia, and Finland. View all Schengen countries.

England, Scotland, Wales, Ireland, and Northern Ireland are not included in the Schengen Treaty, so they do not need travel insurance. Romania, Bulgaria, and Cyprus also do not require insurance. Nonetheless, it is advisable to have European travel insurance as a precaution.

Any travel insurance that includes medical-hospital expenses coverage of 30 thousand euros or higher is accepted for travelers entering Europe. Explore the various insurance plans offered for this purpose.

European insurance plans from the Promo Insurance Online Comparison website can be paid for using a secure credit card for travel.

The AC 500 EUROPE (excluding USA) COVID-19 plan is highly recommended for those looking for comprehensive coverage in case of lost baggage, offering 2,000 euros for this scenario. Explore other insurance options available for Europe.

The Schengen Treaty was created to make border procedures easier between European countries. As a result, you need to have valid travel documentation during your stay, or you may be deported by the authorities for failing to meet this requirement.

If your medical expenses go beyond what is covered by your travel insurance, you will have to pay the additional costs yourself. It is advisable to invest in a more inclusive insurance plan to avoid this situation.

ETIAS is an online travel authorization that Brazilian travelers will need to obtain in order to enter Europe starting in 2025. In addition to ETIAS, another essential requirement is ensuring safe travel.

You can activate your secure European vacation package to receive help with locating lost luggage or getting compensation for any damage incurred. To do this, select an insurance policy that includes coverage for baggage damage.

One convenient method to compare various travel insurance plans in Europe is by utilizing an insurance comparison website.

Aside from being required in Europe, travel insurance offers various additional advantages. Travelers who are insured can experience their trip with greater peace of mind. Check out the available insurance plans on the comparison tool.

There are travel insurance options available for seniors up to the age of 99, like the AC 500 EUROPE plan (excluding the USA) that covers COVID-19. Prices typically increase after the age of 64. If you require assistance, reach out to the insurance comparison service directly to make a purchase.

Certainly! There is a specific coverage for dental issues, and eye care services are included in the overall health coverage. Please review the insurance comparison tool for more details on the available plans.

You don’t need to get insurance for every country you visit, but it’s important to ensure your insurance covers you for the entire duration of your stay in Europe. Check out insurance options specifically designed for European travel.

The travel insurance for Europe typically includes coverage for pre-existing or chronic conditions, as long as they are disclosed to the insurance company when purchasing the policy. Make sure to verify this with your insurance provider for Europe.

The assistance provided by travel insurance in situations of document loss or theft is meant to offer guidance and support to ensure you are not left stranded and know how to proceed. Check out insurance options specifically tailored for travel in Europe.